Get the free caesars w2 forms online

Show details

Can I get my w2 form from little Caesars online W2

Management provides online access to your W2 Can I get my w2 form from little Caesars online

Wage and Tax Statement, Remember my ID on

this Computer?

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign little caesars w2 former employee

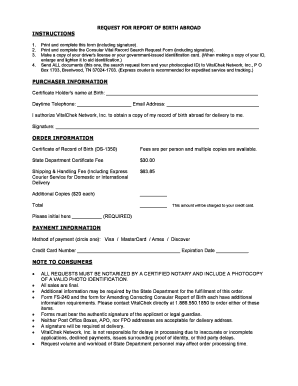

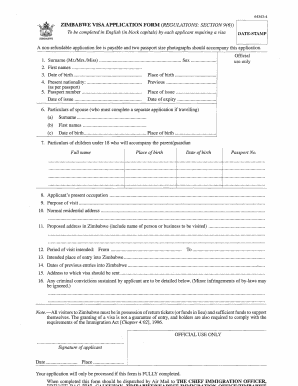

Edit your little caesars email form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 1 800 722 3727 email form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 800 722 3727 email online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit little caesars w2 form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out alliancehcm form

How to fill out the Little Caesars W2 form and who needs it?

01

Start by obtaining the necessary W2 form from your employer, Little Caesars. This form is typically provided to employees by the end of January for the previous tax year.

02

Carefully review the personal information section of the form, which includes your name, address, and Social Security number. Ensure that the information provided is accurate and up to date.

03

Proceed to the income section of the W2 form, which is divided into boxes. Box 1 displays your total wages, tips, and other compensations for the year. Box 2 indicates the federal income tax withheld from your earnings, which is a crucial figure for your tax return.

04

Verify the accuracy of boxes 3 and 5, which report your Social Security wages and tips and Medicare wages and tips, respectively.

05

If you had any pre-tax deductions, such as contributions to a retirement plan or healthcare expenses, review box 12. This box may contain various codes indicating the specific deduction type.

06

Continue to box 14, which may include additional information such as union dues or educational assistance. Ensure that all relevant details are accurately recorded.

07

The last section of the W2 form is for your employer's information. It includes their name, address, Employer Identification Number (EIN), and their contact information.

08

After confirming that all the information on the W2 form is correct, keep a copy for your records and submit the original form to the appropriate tax authority when filing your tax return.

09

As for who needs the Little Caesars W2, it is necessary for all current and former employees of Little Caesars who received wages or salaries during the tax year. This form is used to report income and taxes paid to the Internal Revenue Service (IRS) for the purpose of filing an accurate tax return.

Note: It is important to consult with a tax professional or refer to the relevant tax laws and regulations to ensure compliance and accuracy when filling out the Little Caesars W2 form and completing your tax return.

Fill

employer identification number ein

: Try Risk Free

People Also Ask about 1 800 722 3727

How do I contact Little Caesars?

ing to the USDA, if your pizza has been refrigerated at a temperature lower than 40 degrees Fahrenheit, it's safe to eat up to four days.

How do I cancel my Little Caesars order?

If you need to cancel a store order you placed on the Little Caesars app or via Door Dash, please call 800-722-3727.

How do I get my w2 from Paycor?

I get paid every week through direct deposit. I get my paycheck every Friday morning. The week I started working there.

What system does Little Caesars use?

The Pizza Portal pickup's proprietary technology has been co-developed with Apex Supply Chain Technologies®, the world's leading provider of automated dispensing system, exclusively for Little Caesars.

What payroll platform does Little Caesars use?

AllianceHCM is the payroll provider of {company}.

Does Little Caesars have an app?

Little Caesars® has always been the world's easiest way to pizza®. But with the Little Caesars app, we've made the easiest way even easier! Order pizza, pick up pizza (or have it delivered) and enjoy pizza.

Who is the founder of Little Caesars?

Does Little Caesars accept contactless payments? Yes!

How do I report a problem with Little Caesars?

Please call Customer Care at 1-800-722-3727 so our team may look into this.

Does Little Caesars do direct deposit?

I get paid every week through direct deposit. I get my paycheck every Friday morning. The week I started working there.

Does Little Caesars have touch to pay?

Although most people will recognize the ubiquitous PIZZA! PIZZA! slogan mark owned by the pizza chain Little Caesar's, the company's collection of repeated term marks does not rise to the level of a “family of marks” ing to the Trademark Trial and Appeal Board.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 800 722 3727 without leaving Chrome?

caesars w2 forms online can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the caesars w2 forms online in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your caesars w2 forms online right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Can I edit caesars w2 forms online on an iOS device?

Use the pdfFiller mobile app to create, edit, and share caesars w2 forms online from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is Little Caesars W2?

The Little Caesars W2 is a tax document that reports an employee's annual wages and the amount of taxes withheld from their paycheck.

Who is required to file Little Caesars W2?

All employees of Little Caesars who earn wages and have taxes withheld are required to receive and file a W2 form.

How to fill out Little Caesars W2?

Employees do not fill out their own Little Caesars W2; it is filled out by the employer. Employees simply receive the completed form for their records and tax filing.

What is the purpose of Little Caesars W2?

The purpose of the Little Caesars W2 is to provide a summary of an employee's earnings and tax information for the year, which is necessary for filing personal income tax returns.

What information must be reported on Little Caesars W2?

The Little Caesars W2 must report the employee's name, Social Security number, total wages earned, total taxes withheld, and other relevant tax information.

Fill out your caesars w2 forms online online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Caesars w2 Forms Online is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.